How Global Payment Networks Are Changing in 2025 — and How Fintech Platforms Are Responding

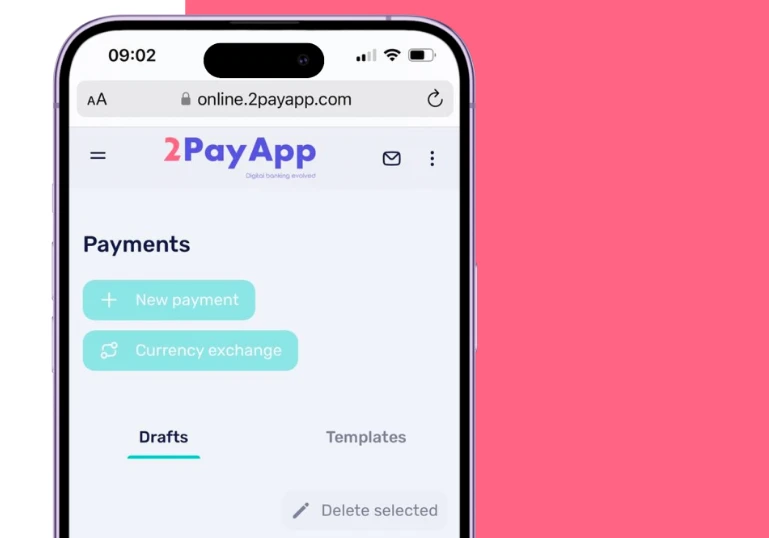

Businesses are demanding speed, transparency, and flexibility — and platforms like 2PayApp are helping them meet these expectations through seamless access to modern international payment networks.

The rise of instant payment rails, real-time tracking, and API-first infrastructures is pushing the global financial ecosystem into a new phase. Traditional banking is struggling to keep pace — but fintechs are already there.

Payment Infrastructure Is Evolving — Fast

Cross-border B2B payments reached $39 trillion globally in 2024, and volume is expected to grow another 10–15% in 2025. As businesses expand across markets, they increasingly rely on flexible multi-currency setups and instant settlement capabilities.

Key developments shaping the new landscape:

- ISO 20022 becomes the mandatory global messaging standard, improving data quality and interoperability

- SEPA Instant expands across Europe, enabling euro transfers to settle within seconds

- SWIFT gpi covers more than 4,000 institutions, with 92% of transactions now settled in under 24 hours

- Alternative payment rails (e.g. blockchain-based networks, stablecoin corridors) are being piloted or adopted in regulated ecosystems

These shifts aren’t just technical — they directly affect how businesses invoice, pay, and reconcile transactions across borders.

Fintech’s Response: Unified Access, Faster Outcomes

Instead of building costly integrations with each network or waiting for banks to modernize, companies are turning to fintech platforms that deliver unified access to SEPA, SWIFT, and local rails through a single API.

For example, 2PayApp allows businesses to:

- Open multi-currency accounts with dedicated IBANs in under 24 hours

- Send and receive payments in EUR, USD, GBP and more — across multiple networks

- Leverage ISO 20022-compatible messaging and real-time tracking

- Automate payouts with full transparency and auditability

- Convert crypto to fiat as part of a broader treasury strategy

With built-in compliance and automated onboarding, fintech platforms enable companies to focus on operations — not bureaucracy.

What Modern Businesses Now Expect from Cross-Border Payments

- Speed

Transfers must settle within seconds or hours — not days. Instant rails are becoming the default.

- Transparency

Real-time tracking, clear statuses, and complete cost breakdowns are now expected features.

- Multi-network compatibility

Businesses want one account that works with SEPA, SWIFT, ACH, and local schemes.

- Automation

Batch payouts, recurring payments, and reconciliation must be API-driven and customizable.

- Minimal friction

No more weeks of onboarding or endless document requests. Instant access is the new baseline.

A Strategic Advantage for Global Companies

Companies using modern payment platforms in 2024–25 report:

- Up to 40% lower FX and transfer fees

- 60–80% faster settlement times

- Improved cash flow forecasting and control

These benefits are no longer optional. They define whether a business can scale efficiently — especially in e-commerce, SaaS, digital services, and global trade.

Platforms like 2PayApp are not just reacting to industry changes — they are actively shaping how the next generation of payment infrastructure works.